The Recession will be very severe – and cause the largest Market Crash since the Crash of 1929.

Outlook for recession (January 2024)

In early 2023, I said that I would be met with doubts and the question of “Why Recession? as the stock market soared into late 2023 – and continues to do so into 2024. Now we are here! My doubters are rising (and will continue to do so, as the market strengthens in the coming months)

The arguments are: 1) “We already had the Recession in ’22” 2) “Fed is aware and will not allow it” 3) “Fed has changed the Game” 4) “We are in a new liquidity cycle” 5) “It will not be allowed in a Presidential Election year” ….. and so on! All chitchat – and based on a complete lack of understanding of the Business Cycles. So – why the Recession? (….this is giving more than I should – so stay tuned)

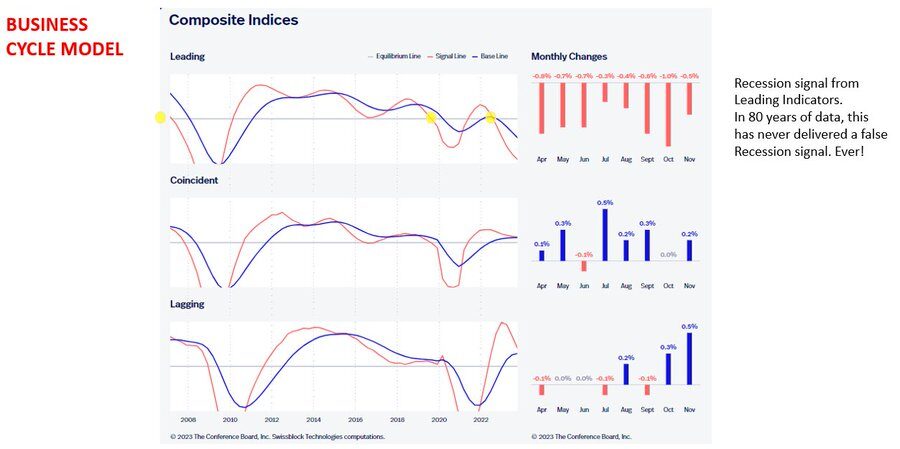

The first argument is based on our Business Cycle Model developed with Swissblock and

Our Business Cycle has flashed a Recession signal in 2023.

Leading Indicators have crashed under our Equilibrium Line. In 80 years of data, the Recession Signal from our Model has NEVER been wrong. No false signals – ever!

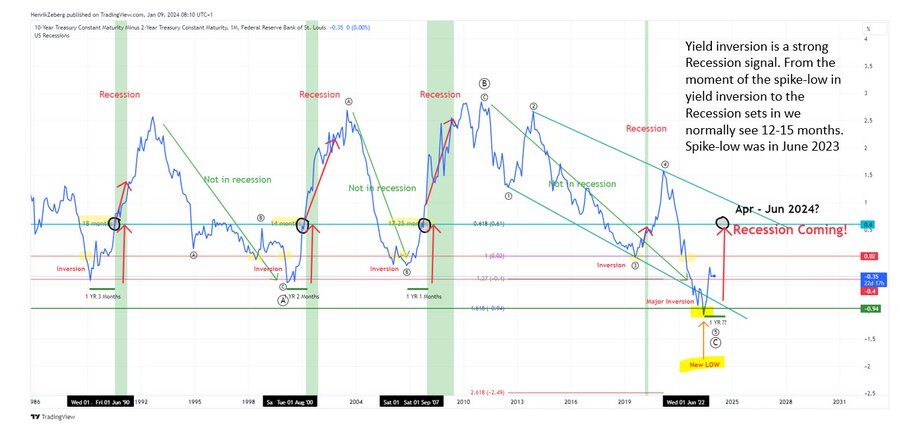

The second argument goes on the Yield Inversion. Yield inversion is a signal of the coming Recession. Not immediately – but eventually. Analysts have observed this signal in 2023 – but due to impatience dismissed it. This is a great mistake.

From the bottom of the Yield Inversion, we normally see 12-15 months before a Recession sets in. The bottom was in June 2023. This signal is very much alive!

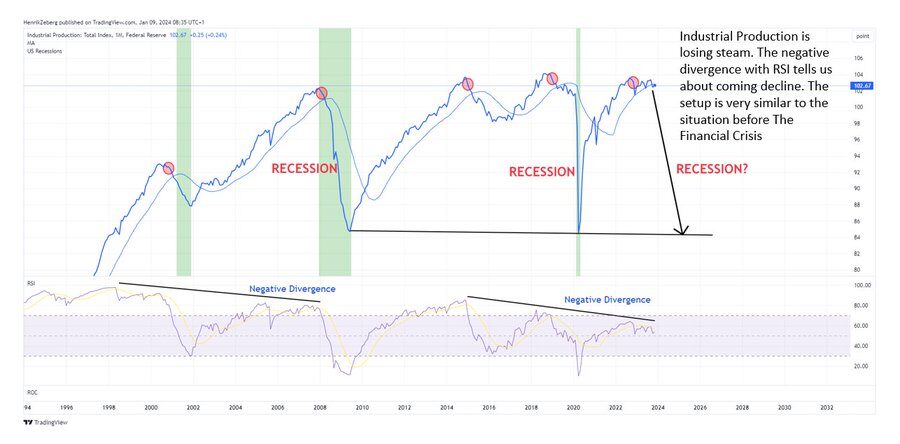

The third argument is based on the outlook for Industrial Production. The setup is similar to the situation just before the Financial Crisis. Rising level after #Corona but the strength of the move is dominated by divergence (RSI).

This is a complete mirror of what we saw going into 2007-08. Industrial Production is about to drop strongly and a Recession will set in.

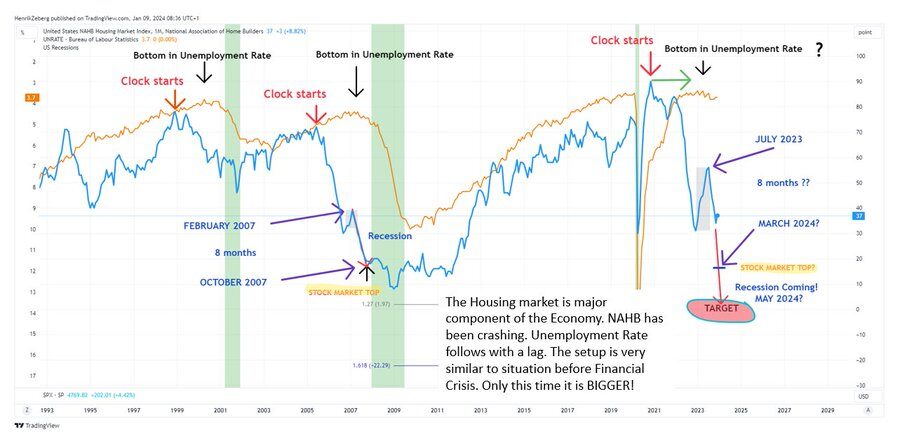

The fourth argument goes on the Housing Market. It has plummeted. NAHB and the Housing Market lead to Unemployment. As Housing is hit by higher rates – people start to save their money.

They consume less, which deteriorates the Economic environment. It does not happen instantaneously – but eventually.

The bigger the decline in NAHB – the larger the rise in Unemployment. …. and the current decline in NAHB is larger than the decline before the Financial Crisis. Just like in 2007, we haven’t seen a strong move in Unemployment …. yet!

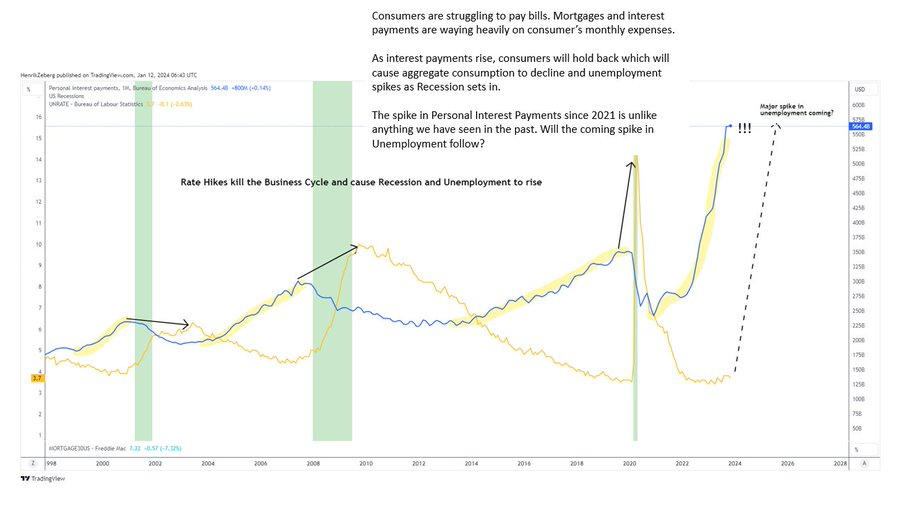

5th argument is related to the rise of Personal Interest Payments. As market rates rise – consumers are hit on their mortgages and other debt. Every rise in rates over the years has caused a Recession, as consumers need to pull back on their Consumption.

This causes Unemployment to start to rise. Again – it does not happen immediately – but eventually! This is the normal lag in the Economic Business Cycle. And we have just seen the largest spike in Personal Interest Payments – ever! A parabolic rise in Unemployment can be expected

6th argument is on Housing Affordability. As Interest Payments rise – Housing Affordability plummets. We are currently at levels below the situation going into the Financial Crisis.

The only reason we don’t see the watershed moment yet …. is because the consumer has not lost his job…. yet! When the unemployment situation deteriorates a lot of people will lose their homes as default rates skyrocket.

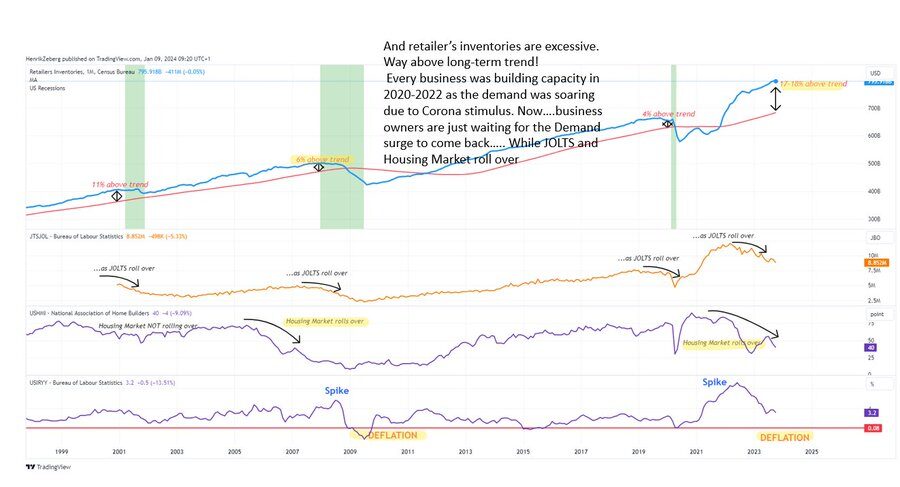

7th argument is based on the Retailer’s inventory levels. Companies and retailers around the World have filled their storages and inventories – expecting the hype in Demand that they experienced in 2021-22 to come back again… (due to stimulus).

Only this Demand is gone. The stimulus is gone! Retailer’s inventory levels are way above the trend line – while JOLTS and the Housing Market roll over. What could go wrong?

Conclusion A Major Recession will set in. The Titanic has already hit the Iceberg – and it will sink. There is nothing that can be done by the Fed or any administration.

The consumer is hurt badly through Housing and Personal Interest Payments – and will soon feel unemployment as well. The Recession will be worse than 2007-09!

The stock market faces a severe recession, the worst since 1929. Retailers’ inventory levels are high, and JOLTS and the Housing Market are declining. A major recession is inevitable and expected to be worse than 2007-09.

Leave a Reply